GCC Earnings Calls: Sentiment Weathers Market Uncertainty, Aided by Financials Sector

16 March 2023 | Oliver Schutzmann, CEO

Iridium Quant Lens, a natural language processing algorithm, has analyzed over 7.0 million words from 1,380 historic GCC earnings calls. The purpose of this analysis is to quantify what management teams, analysts, and investors are conveying to the market. In a new report, we share our findings for FQ4 2022 and provide an overview of the GCC market sentiment. Key highlights:

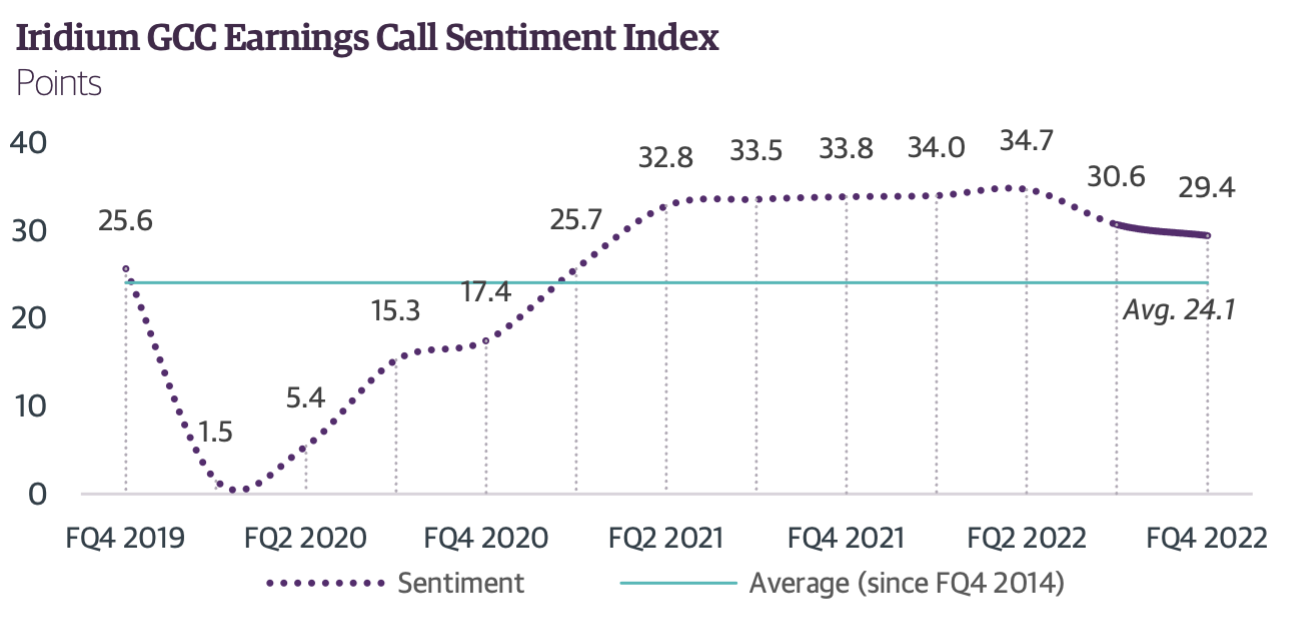

Decline in GCC Earnings Call Sentiment Index

Confirming our preliminary findings published in mid-February, the Iridium GCC Earnings Call Sentiment Index has declined further in FQ4 2022, reaching +29.4 points. External pressures from higher interest rates, inflation, volatility in oil prices, and fears of a recession in the largest global economies weighed on GCC companies. Nevertheless, the index remains more than 20% above the historical long-term average, supported by robust aggregate financial results during FY 2022.

Strong Correlation with MSCI GCC Index

Iridium's Sentiment Index has a 95% correlation to the MSCI GCC Index, revealing the strong relationship between the sentiment of language used by management teams and the investment community during earnings calls and capital markets prices.

Missed Expectations and Increased Uncertainty

54% of companies reported earnings that "missed" analysts' expectations in FQ4 2022, exceeding those that "beat" expectations for the first time since FQ2 2021. This coincided with an increase in uncertainty displayed in earnings calls during the quarter.

Lower Sentiment Bias

The Sentiment Bias, a measure of the sentiment gap between the management presentations and the question-and-answer sessions in earnings calls, has increased short-term but is declining on a long-term basis. This reflects a significant improvement in the quality and professionalism of GCC companies' earnings calls since 2015.

Financials Sector Mirrors Overall GCC Trends

The overall GCC trends were mirrored in the Financials sector, where sentiment during 2022 remained above pre-pandemic levels on strong aggregate financial results. However, sentiment was similarly pressured during FQ4 2022 as uncertainty rose, and the outlook for lending growth moderated.

Saudi Arabia and UAE Outperform

Despite the declining sentiment index, Saudi Arabia and United Arab Emirates' FQ4 2022 sentiment remained close to the upper level of their respective historical ranges since 2014. The financial sectors of both countries stood out in 2022, with results benefitting from the rising rate environment and overall post-pandemic economic expansion. However, sentiment in most other economic sectors was subject to additional pressure from both sector-specific and external factors.