Iridium Quant Lens Natural Language Processing algorithms analyzed 6.7 million words from more than 1,300 historic GCC earnings calls to quantify what management teams, analyst and investors are telling the market.

Iridium's new report reveals that:

-

While GCC earnings calls sentiment may have remained resilient during the first half of the year 2022, the GCC market is not immune to equity market contractions in emerging and developed markets, rising interest rates, inflationary pressures, oil price volatility and fears of recession.

-

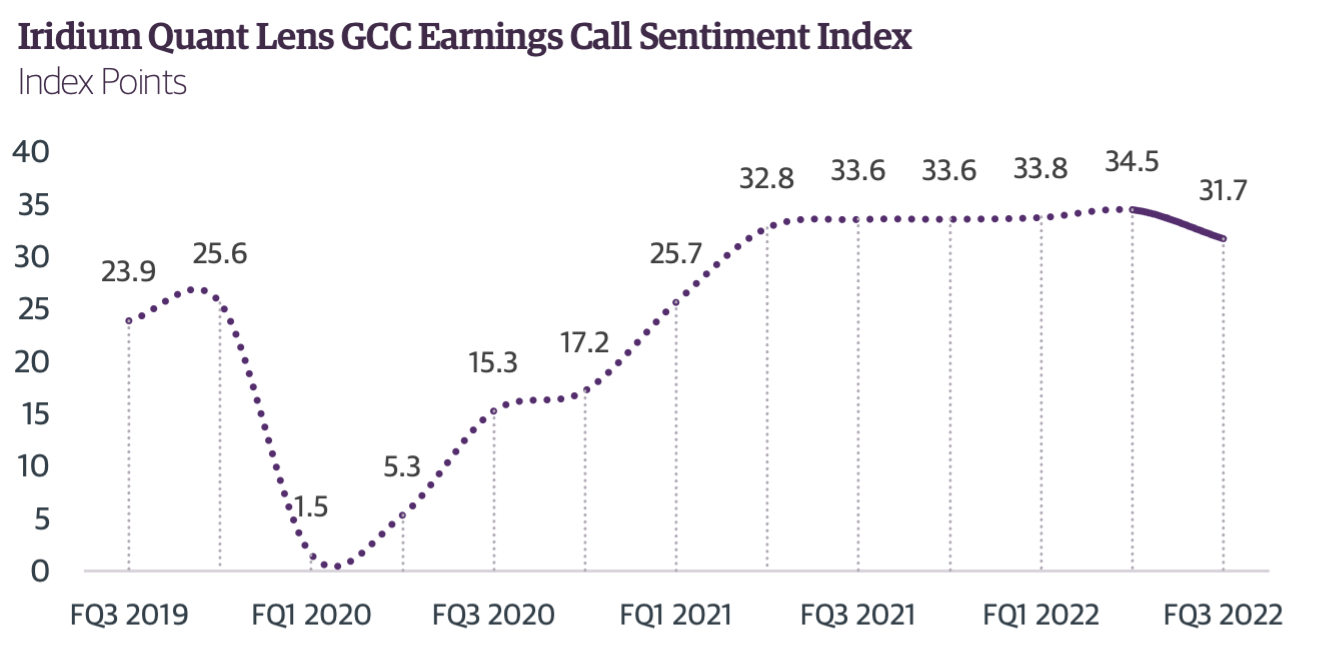

The Iridium GCC Earnings Call Sentiment index dropped 8% to reach +31.7 points in FQ3 2022, down from +34.5 points in FQ2 2022. This is the lowest sentiment level since FQ1 2021.

-

The drop in the GCC Sentiment Index is particularly driven by a decrease in sentiment during management presentation sessions in FQ3 2022.

- The trend in sentiment continues to broadly track corporate profitability and the MSCI GCC Index, which also declined over the last quarter and coincides with a decrease in the number of companies that "beat" analyst estimates in FQ3 2022.