Early Insights into GCC Sentiment Trends during 4Q 2022 Earnings Cycle

16 February 2023 | Admin

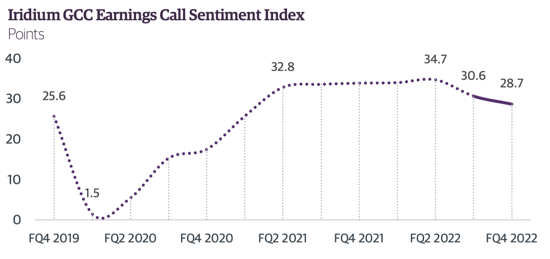

With the fourth quarter 2022 earnings cycle in full swing, we conducted a preliminary analysis of the first 30 available earnings call transcripts to date to gain early insight into GCC corporate and investor sentiment trends. The results of this analysis indicate that the declining sentiment witnessed during the previous fiscal quarter appears to have continued during earnings calls hosted between January and February 2023 (FQ4 2022).

Earnings Call Sentiment Declined in 3Q 2022

The Iridium GCC Earnings Call Sentiment Index dropped 4.1 points or 12% quarter-on-quarter in the preceding quarter (3Q 2022). While GCC earnings call sentiment may have remained resilient during the first half of the year 2022, it was unlikely that GCC markets would remain immune to equity market contractions in global emerging and developed markets, and to the impact of rising interest rates, inflationary pressures, oil price volatility, and fears of recession.

Preliminary analysis of 4Q 2022 confirms this view

Iridium's new report reveals that:

- Our preliminary analysis of the first 30 available earnings call transcripts indicates a further 1.9 point or 6% drop in the overall Iridium GCC Earnings Call Sentiment Index to +28.7.

- Last quarter, the drop in the Index was attributed to a decrease in sentiment during management presentation sessions, while this quarter, it is from the analyst and investor community during the Q&A sessions.

- This divergence may reflect Strong management confidence and positivity from robust aggregate financial performances for GCC companies during the fourth quarter and full year 2022 overall, as evidenced by the slightly greater proportion of earnings beating analyst expectations.

- The future outlook is a more important driver of sentiment for analysts and investors, and the deterioration in their sentiment has coincided with further declines in GCC equity markets – a clear indication of more difficult times to come.

In summary, our preliminary analysis of the fourth quarter 2022 earnings season reveals a continuing deterioration in GCC earnings call sentiment, driven by the analyst and investor community. This decline in sentiment corresponds with further declines in GCC equity markets, and it is a clear indication of the challenges that lie ahead. It is essential for GCC companies to remain resilient in the face of these challenges and continue to communicate with transparency and clarity during earnings calls to mitigate the impact of negative market sentiment.